Pay TV Providers Like Televisa Are Adapting to Mexico Viewers' Growing Digital Habits

This article was originally published on eMarketer's blog. Click here to read this and other articles.

From classic telenovelas (soap operas) to sports, TV has played a pivotal role in Mexico. But as digital video continues to vie for consumers’ attention, our estimates show that nearly half (48.4%) of Mexico’s population—or 61.0 million people—will watch streaming or downloaded video content via any device at least once per month in 2019.

As broadband and mobile internet speeds continue to improve and more people go online for the first time, a nascent cord-cutting culture is taking hold. This is affecting the pay TV landscape, which we discuss in our recent report, "Latin America Digital Video 2019."

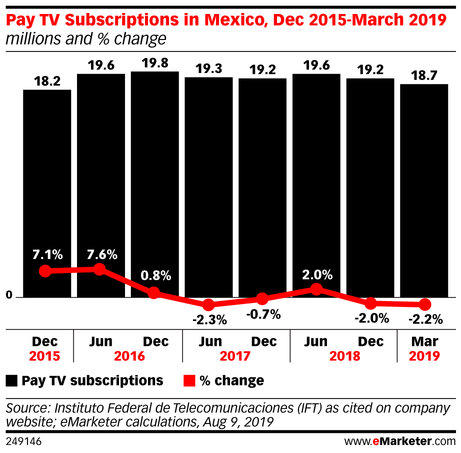

According to Mexico’s Federal Telecommunications Institute (IFT), the number of total pay TV subscribers in Mexico decreased from 19.2 million in December 2018 to 18.7 million by the end of March 2019. Despite this, Mexico is still Latin America’s biggest pay TV market, according to calculations based on data from local government agencies.

So how have local players responded?

Mexico’s Televisa is one of the country’s most powerful and influential TV networks, controlling 59.9% of the pay TV market, according to March 2019 data from the IFT. Televisa has played a major role in boosting the popularity of Spanish-language TV content, having produced some of the most popular telenovelas in Mexico—and arguably all of Latin America.

And because of changing video-viewing behaviors, Televisa has had to adapt its strategy, including what it does on YouTube. Andrés Bayona, content and digital production manager at Televisa, said that using YouTube’s “Premieres” feature has been effective in bridging the provider’s TV and digital video content.

YouTube officially launched Premieres in June 2018, which lets content creators debut pre-recorded videos as a live moment. When creators release a Premiere video, YouTube automatically creates a shareable watch page to build anticipation and hype around the new content. Through the watch page, viewers can chat with each other and the creator in real-time, building a sense of community around the content. Several networks now use Premieres to air the first 10 to 15 minutes of a show, while simultaneously broadcasting it on linear TV.

Televisa has used Premieres to test the waters and create new types of disruptive and appealing content. For example, the company includes a call to action for certain programs, inviting viewers to continue watching on TV.

“We discovered that YouTube is an excellent platform to allocate digital long-form content, as well as a great way to serve as an extension of linear productions or what you essentially see on the TV screen,” Bayona said. “We’ve had great success finding these integrations between linear TV and digital through YouTube with this strategy.”

As Mexican consumers’ viewing habits continue to change, no single company can predict what the future holds. However, Bayona firmly believes that “you can certainly create it—and [doing so through] video content is a great way to do that.”

For more research on digital video in Latin America, eMarketer PRO subscribers can read our latest report: "Latin America Digital Video 2019."