Latin America Ecommerce 2018: Digital Buyer Trends for Argentina, Brazil and Mexico

Executive Summary

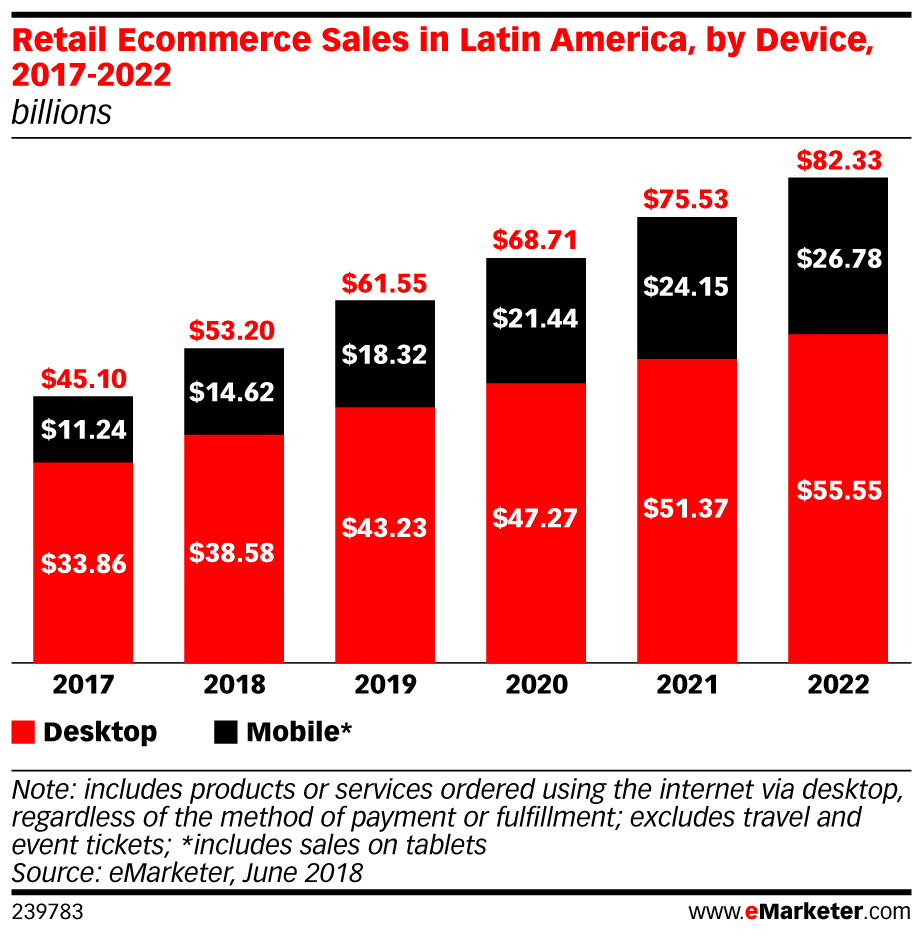

In 2018, eMarketer estimates, total retail ecommerce sales in Latin America will grow 17.9% to $53.20 billion. Despite rising consumer prices, economies are beginning to recover, and that—coupled with newly elected presidents—has shored up consumer confidence.

This report offers regional and country-by-country figures for retail sales, retail ecommerce sales, retail mcommerce sales and digital buyers in Latin America, Argentina, Brazil, and Mexico—in addition to digital buyer demographics, barriers to ecommerce, as well as leading retail ecommerce websites and mobile apps.

What is the forecast for retail sales in Latin America 2017-2022?

We expect that retail sales will grow 5.1% to $1.988 trillion this year, making the region the world’s fourth largest retail market. Total retail sales will continue to increase, reaching $2.354 trillion by 2022. Brazil will hail as the region’s largest retail market, accounting for almost one-third (32.8%) of all regional retail sales this year, followed by Mexico with a 20.2% share.

What are the top ecommerce sites in Latin America?

Argentina-based digital marketplace MercadoLibre is Latin America’s most popular platform—with 56.3 million unique desktop visitors during May 2018. Amazon sites took distant second place with 22.4 million, followed by sites owned by Brazil-based B2W Digital (16.1 million) and Alibaba (11.8 million). eBay rounded out the top five retail sites in Latin America, with 9.5 million.

What percentage of retail ecommerce is coming from mobile?

This year, for the first time, mobile will make up more than one-quarter (27.5%) of all retail ecommerce sales in Latin America, totaling $14.62 billion. Continued investment in digital infrastructure, improved mobile internet access, less-expensive data plans and rapid smartphone adoption have been key drivers for continued mcommerce growth.

What's in this report?

This report provides a regional and country-by-country analysis for retail sales, retail ecommerce sales and mcommerce sales in Latin America, as well as breakouts for Argentina, Brazil, and Mexico.

It also includes estimates for digital buyers and explains local consumer trends such as digital buyer demographics, barriers to ecommerce, leading retail ecommerce websites and mobile apps.

The full data set for this forecast, which runs through 2022, is also included. You can also listen to eMarketer's latest podcast on the topic where we discuss the above trends and more!